The Bare Bones

Money can be easy. I believe that most people can massively improve their personal finances by just focussing on some basic principles.

The basics are as follows:

- Build an Emergency Fund

- Grow the Gap

- Invest the Gap

Following these basics won’t solve all of your money problems. However, it should put you in a much better position than before.

Thinking of money in this way has helped me to improve my finances massively.

Many people make the mistake of trying to run before they can walk. Once you have the basics in order, you can focus on more complicated things.

Remember – a strong foundation is essential!

Build an Emergency Fund

An emergency fund is some cash that you stow away in case of an emergency. I like to keep at least 6 months of expenses in my emergency fund.

I think it goes without saying why you’d need an emergency fund, but since so few people seem to have one, I’ve taken the liberty of listing some reasons that having an emergency fund might come in handy:

- Medical emergencies

- Car repairs

- Legal fees

- Job loss

- Natural disasters

- Family emergencies

- House repairs

- Getting stranded far from home

- Rapid increases in the cost of utilities

- Geopolitical unrest

- Theft

- Scams

If you believe that you’ll never run into a financial emergency, then I admire your bravery … and stupidity.

Grow the Gap

To calculate your gap, use the following formula:

Your net income – Your expenses = Your gap

If your gap is a negative number, this means that you’re spending more than you’re earning. This is obviously a major problem, and your top priority should be making it positive again.

Once your gap is positive, you can begin to grow it.

There are two methods to grow your gap:

Method 1: Lower your expenses.

Here are some common examples of how you can lower your expenses:

- Look for better deals on utilities.

- Avoid unnecessary debt.

- Try to decrease your expenses by 1% each month.

- Move somewhere else with cheaper rent or mortgage costs.

- Write down every expense you have and try to make cuts.

Method 2: Increase your income.

Here are some common examples of how you can increase your income:

- Increase your salary by upskilling.

- Try to negotiate a higher salary.

- Change jobs for a higher salary.

- Work more than one job.

- Try to start a business alongside your main job.

Obviously, the more of these you can do, the better off you’ll be in the long run.

If you wish to quickly calculate your monthly gap and emergency fund requirements for six months, feel free to check out the calculator.

Invest the Gap

Investing is the key to wealth building. The bigger the gap between your income and expenses, the more you can invest.

Personal finance is not a one-size-fits-all type of thing. This is especially true when it comes to investing. What you should invest in, how much you should invest, and how often you should invest all depend on your personal circumstances such as your age, the amount of money you have, and the tax situation in your jurisdiction.

For these reasons, I’m in no position to tell you what you should be investing in.

However, almost everybody can benefit from having a long-term view when it comes to investing. I believe this for two main reasons.

Reason 1: The compounding effect.

If you invest consistently and leave your money in the market, the compounding effect of market gains can benefit you greatly. You’ll also avoid a whole lot of unnecessary tax and commissions.

Let’s imagine you’ve grown your gap well and you’re in the very fortunate position of being able to invest 500 EUR (or your country’s equivalent) in the market every single month.

Now, let’s imagine that you had a yearly return of 6%. This is a fairly achievable average return that you could expect to get from a broadly market following fund.

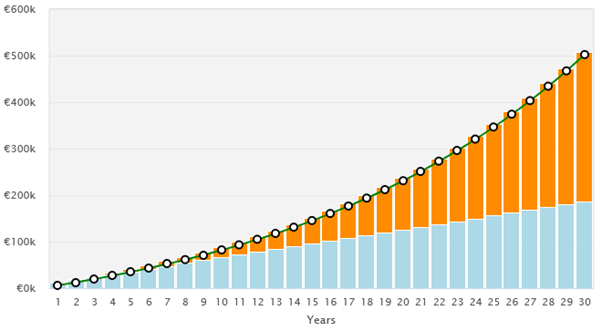

This is what your account value would look like over the long term:

- 10 years: 81,939.67 EUR total value – with 60,000 EUR invested.

- 20 years: 231,020.45 EUR total value – with 120,000 EUR invested.

- 30 years: 502,257.52 EUR total value – with 180,000 EUR invested.

To get a better understanding of this, look at this graph displaying 30 years of compounding growth using the figures from before:

The blue represents your deposits, and the orange represents the compounded gains you’ve accrued from investing.

As you can see, the compounded gains (orange) greatly increase relative to the amount you invest (blue) as time goes by. This is due to the compounding effect of the market.

Reason 2: Avoiding short-term volatility.

The harsh reality of the world is that the market does not always go up. However, if you truly have a long-term view when it comes to investing, short-term downswings shouldn’t worry you too much.

Also, short-term trading almost never works in the long run, but that’s a topic for another day.

When it comes to investing, simply staying in the market for long enough gives you a massive advantage. If you panic sell at every major downswing, the compounding effect mentioned above won’t be able to work its magic.

Let’s imagine a real-life example: You put some money into an S&P 500 fund just before the COVID-19 lockdowns. In a disturbingly short span of time, you see that your investment has gone down by over 30%. Many people panic sell in situations like this. With the benefit of hindsight, we can see that selling at this point would have been an awful idea for most people. This is because the market has since recovered far beyond the high point that it fell from prior to the lockdowns.

Now, don’t get me wrong – not every investment is necessarily a good investment and there are appropriate times to sell depending on your life circumstances or what you’ve invested in.

My point is that short-term volatility is to be expected. If you’re not comfortable holding during such times, you probably shouldn’t be involved in investing in stock markets. This is because you either don’t have the right mentality for it or you invested in something unsuitable for your needs.

The basics that I mentioned above will not fix all your financial problems, but I believe they will help most people avoid the most common personal finance pitfalls. If you’re stuck with mountains of debt, you’ll have to tweak these steps a bit, but a lot of the general concepts still apply.